Should You Refinance Your Student Loans?

Many savvy graduates are looking to student loan refinance to pay off loans quicker – lower interest rates, better terms, more affordable payments, and being able to choose your loan company are all huge perks. This is a great opportunity to leverage a college education to save money and make life more convenient!

Refinancing student loans is a good option, but it’s not perfect for everyone. Answering just a few questions can help you determine if a student loan refinance is right for your situation.

How much can you save by refinancing?

If you were offered $100 to refinance your student loans over the loan lifetime, would you do it? What if the return was $10,000? Knowing how much you can save can be a great gauge to refinance.

A strong credit score not only boosts your chance of approval, but also the savings you can expect. Top-tier credit scores will see the most benefits from refinancing, as the rate offered will be lowest, but any reduction in interest rate from the original loan is beneficial.

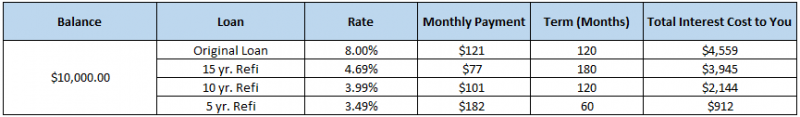

Depending on the term you select, you may see monthly savings, long-term savings, or both. For example, a $10,000 loan at 8% will cost about $121/month if the loan is paid off in 10 years.

Refinancing the loan over ten years at 3.99% saves $20/month and almost $2,400 over the life of the loan, or save about $3,600 by paying $61 more per month and shortening the term to five years!

Learn how much you can save by completing our student loan refinance calculator with your loan info – we’re happy to help!

Note: These numbers and examples are for educational purposes and may not reflect your own personal savings. Every financial situation is unique - rates and savings are influenced by a number of factors.

*Disclaimer: Interest rates listed do not constitute offers of credit and may not reflect available rates at 3Rivers FCU. Available rates are subject to change without notice.

What are your short and long-term financial goals?

Think through this before starting the refinance process – where do you see yourself in one month, five years, and 20 years – and what will refinancing do to help you get there? What will your finances look like at each of those times? It may be the first step to saving for retirement, moving into your dream home, or buying a more family-friendly car!

Paying off loans in five years sounds great, but is the monthly payment affordable, and will it be affordable with a new house payment? Keep these situations and plans in mind when determining if refinancing is right for you. 3Rivers is committed to helping our members understand their money matters – and we want to help you achieve all your goals.

Do you plan to use Federal student loan benefits?

If you have only private student loans, there aren’t too many benefits to discuss.

Federal loans, on the other hand, offer repayment options for many students. Some of these benefits, like income-based repayment (and similar plans) can reduce monthly payments and qualify some borrowers for loan forgiveness.

Teachers, non-profit employees, and other public service workers can receive this loan forgiveness in as little as ten years. Other careers may not see this benefit for at least 20 years, so your mileage may vary.

Federal loans also come with built-in protections if the borrower becomes injured, is unable to work, or passes away. You may pay a higher interest rate for these benefits, which can be thought of like an insurance premium. Read about all benefits offered here (look for “How to Repay Your Loans” on the right-hand side.)

Refinancing federal student loans removes many of these benefits. If you feel more comfortable with the protections, it may be best to leave these loans out of any refinance plans for now. If you don’t plan to use them, though, and don’t want to pay the included costs of maintaining them, refinancing provides a great opportunity to lower your interest rate and find terms more favorable for paying off student loans!

Where do you want to do business?

Refinancing your student loans allows you to choose how much you pay toward your loans, but as an added benefit, you can also choose where you pay your loans. Private loans come from banks and other lenders that parents choose while students are finishing their undergraduate degrees, and federal loans are determined by the US Department of Education. This is the one of the first choices graduates are able to make regarding their student loans.

On the federal side, there are nine servicers that each receive a portion of loans created that year. Some servicers have past or current legal issues, consistent complaints, and other problems, while others have spotless records. You may have loans with multiple servicers!

Refinancing allows you to choose – do you prefer to continue with your current companies, or would you prefer to do business differently? Both local and online options are available, so you’re able to choose what fits your lifestyle best.

If you’re ready to explore better deals on your student loans, contact us or stop into your nearest branch!