How Your Money is Insured at 3Rivers

Image showing several bundles of hundred dollar bills. In short, the National Credit Union Administration (NCUA) and the Federal Deposit Insurance Corporation (FDIC) are two agencies of the United States federal government that provide nearly identical deposit insurance to credit union members and bank customers. You can learn more about the two agencies at this link.

When choosing where to do your banking, the safety of your deposits should be top-of-mind. If you've ever wondered how your funds are protected at a federally-insured credit union (like 3Rivers) versus a larger bank, read on!

In short, the National Credit Union Administration (NCUA) and the Federal Deposit Insurance Corporation (FDIC) are two agencies of the United States federal government that provide nearly identical deposit insurance to credit union members and bank customers. You can learn more about the two agencies at this link.

What is the National Credit Union Administration (NCUA)?

According to the NCUA, “The National Credit Union Administration, commonly referred to as NCUA, is an independent agency of the United States government that regulates, charters and supervises federal credit unions. NCUA also operates and manages the National Credit Union Share Insurance Fund (NCUSIF). Backed by the full faith and credit of the U.S. government, the NCUSIF insures the accounts of millions of account holders in all federal credit unions and the vast majority of state-chartered credit unions.”

Does one agency (NCUA or FDIC) have better coverage than the other?

The amount of protection offered by the NCUA and FDIC are the same. Each offers the same coverage for share, share draft (checking), share certificates, and money market accounts. Neither agency covers losses on money invested in stocks, bonds, mutual funds, life insurance policies, or annuities offered by affiliated entities.

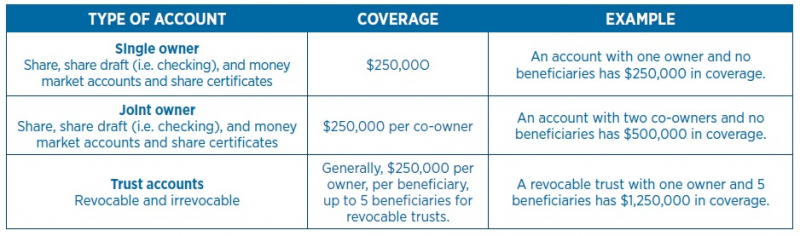

As a member of 3Rivers, your deposits are covered by the NCUSIF, up to $250,000 per account category:

In the past, some larger banks have been “bailed out” by the federal government; yet, this has never been the case with a credit union, thanks to the NCUSIF!

How can I be sure that my credit union is federally-insured by the NCUA (and not privately-insured)?

Look for the NCUA insurance sign (shown below)! All federally-insured credit unions must prominently display this logo in their branches and on their website. And credit unions cannot end their federal insurance agreement without first notifying their members. | Learn more.

Can I get a better idea of how my deposits are covered by the NCUA?

Yes! The NCUA has a free tool—their Share Insurance Estimator—which helps you see how your deposits are covered and further explains NCUSIF’s coverage. You can find it at mycreditunion.gov/insurance-estimator.

Where can I find additional resources on NCUA insurance and how it works?

- Visit the NCUA WEBSITE for information about share insurance coverage.

- Check out THIS BROCHURE that details how your accounts are federally-insured at a credit union.

- Have a look at MyCreditUnion.gov's SHARE INSURANCE RESOURCE GUIDE.

- Read THIS ARTICLE from The Balance on whether credit unions are a safe place to keep your money.