Personal Finance 101: Credit Scores

Your credit score plays many important roles in your finances. Working to build a good, strong score can help to support any budgets you have in place, get you approved for new lines of credit, save you money by helping you to qualify for lower interest rates on loans, and more.

Before you can start building a stronger score, though, it’s crucial that you understand what exactly your credit score is and how it’s calculated.

Your credit score is a number calculated from information found in your credit report. It’s one of the most important factors that lenders use to determine your credit-worthiness – or your likelihood to pay back what you owe when you borrow money for a mortgage, loan, or credit card. The better your score, the more likely you are to be approved for credit at a lower interest rate.

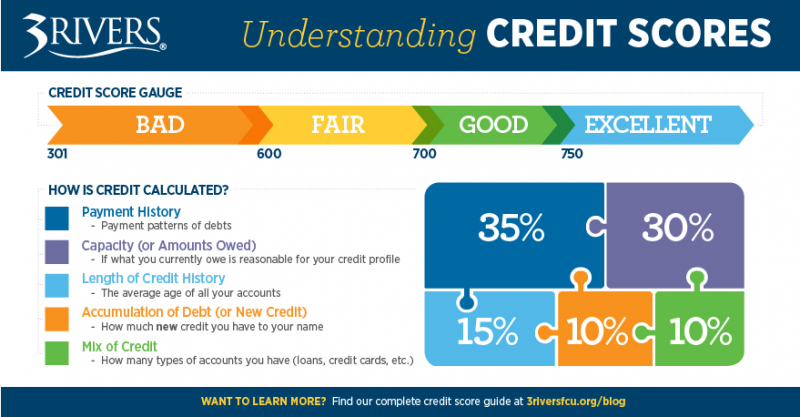

Most credit scores range from 301-850, with “bad credit” being any score below 600, “good credit” being between 700-749, and “excellent credit” being at 750 or higher.

FICO (Fair Isaac Corporation) looks at several pieces of credit data to determine your score. These include:

Payment History – 35%

The most heavily weighed factor in determining your score is your Payment History. FICO takes into consideration your patterns of making payments on your debts (credit cards, car loans, mortgages, and so on.) They look for any reported late payments (delinquencies) or other negative factors (like bankruptcy, foreclosures, liens, and so forth) to get a good look at your overall Payment History.

Capacity (or Amounts Owed) – 30%

The Capacity element looks at how much debt you already have tied to your name, and whether or not that amount of debt is reasonable for your personal credit profile. They’ll look at how much you still owe on debts, what percentage of your available credit amount you’re using, how many accounts have balances, and so forth. Most importantly, they look at your balance-to-limit ratio. If you’re using a high percentage of your available balance, it can indicate that you’re strained financially and may be a high-risk borrower.

Length of Credit History – 15%

For Length of Credit History, FICO takes into account how long your overall credit account has been established. They determine this by finding the average age of all of your accounts. (So, if you have had one credit card open for 10 years and another for 2 years, the average age of your credit account is 6 years (10+2=12 | 12÷2=6.)

Accumulation of Debt (or New Credit) – 10%

FICO next looks at how much new credit you have to your name. Accumulation of Debt is based on how many new credit accounts (or trade lines) you have as well as how many recent “inquiries” your credit report has. Experts advise not opening too many credit accounts too rapidly, as it will lower the average age of your account (See “Length of Credit History” above.) Additionally, this portion takes into consideration how many times lenders have requested your credit report or score (when you’re looking to take out a credit card, auto loan, mortgage, and so on) - which show up as "hard" or "soft" inquiries.

Mix of Credit – 10%

Finally, FICO looks at you overall Mix of Credit. That is, how many different types of credit accounts you have – installment loans (like car or student loan payments) and revolving credit (like a credit card) – and how you use them and pay them off. It’s important to keep in mind that a closed account will still show up on your report and be considered when calculating your score.

You might also like: How to Make Sense of Your Credit Report | How Important is a Credit Rating, Really? | 3 Credit Score Myths, Busted! | How to Use a Credit Card Wisely | Credit Scores: How They're Calculated + How to Improve Yours