Store Cards Are No Match for Credit Cards Issued by Credit Unions

Although there are several advantages to having a store card, a credit card from your local credit union tends to be the better option for daily purchases and maybe your only option for balance transfers and/or cash advances.

All rate and fee amounts mentioned in this post were recorded as of July 29, 2022, and may no longer be accurate. Please visit official merchant websites to view current rates and fees.

Compelled by the promise of discounts and special offers, it’s no wonder many consumers choose to use retailer (store) credit cards. Retailer cards appeal to brand affinity (that is, the store itself) by co-branding the retailer’s likeness while also carrying a network identity, like Visa or Mastercard®. Pair the two together and we end up with options like the Target™ Mastercard® and the Costco Anywhere Visa® Card.

On the surface, it may seem that the only difference between a store card and a credit card issued by a credit union or bank is where it can be used. For instance, a store card can only be used within that specific store, while the “traditional” alternative card can be used anywhere credit cards are accepted. But that’s not truly the case; let’s look closer.

Like any credit card, store credit cards are revolving lines of credit. In short, that means the cardholder gets a set credit limit with the ability to make purchases amounting up to that limit. It’s essentially a buy, now pay later (BNPY) tool without the fancy name or gimmickry. The key difference, though, is that the cardholder can only buy within that retailer’s stores, websites, and/or its affiliated brands.

Limitations of use aside, store cards are structurally the same as credit cards. But what about the intrinsic differences?

Advantages of Store Cards

Store cards do carry some advantages over those issued by financial institutions. Those include:

- It’s sometimes easier to get approved for store-branded credit cards.

- Consumers can often apply and get an approval decision while at checkout.

- Discounts and other promotions are offered exclusively to store brand card holders.

- Some store cards have rewards points that can be used within the retailer’s network.

- Can be a tool for building credit when used responsibly.

- Customers sometimes get discounts, special financing, and other exclusive promotions.

It’s worth noting that no two cards are alike, so some of these advantages may or may not be applicable. That’s why it’s so important to read the fine print of any credit card you’re considering.

Limitations of Store Cards

Now, here are some disadvantages of retailer/store credit cards:

- Store cards may be more prone to hurting your credit. Like any credit card, mismanagement of details can hinder the cardholder’s credit. For that reason, keep your balance low relative to the limit (also known as utilization). A good rule of thumb is to keep it below 30% utilization. Store cards tend to have lower credit limits, which may result in higher utilization. And pay on time every month! One missed payment can have harsh consequences on your credit score and perhaps even lead to a higher interest rate on your balances. Tip: If you're a 3Rivers member, you have 24/7 access to your credit score and can get alerts when it changes using our free Credit Sense tool within online and mobile banking!

- Store credit cards are not accepted everywhere, whereas credit union or bank-issued cards are accepted worldwide.

- There is less purchase protection in instances of fraud and product failure. Most traditional cards offer purchase protections for the consumer. Additionally, many traditional cards offer extended warranties. Many store cards do not do the same.

- Introductory rate offers for traditional cards won't have deferred interest. Instead of low or zero percent intro offers, store credit cards utilize a “deferred interest promotion,” which means you must pay the balance in full before the promotion period ends to avoid being charged interest. Otherwise, if any of the balance remains, you’ll get hit with backdated interest for the entire promotional period.

- Credit union and bank-issued credit cards have broader rewards options. Points from a rewards credit card can be redeemed in a variety of ways, including as a statement credit or cash back, travel points, or even pay-with-points options at select retailers, like Amazon.

- Store cards have notoriously higher average interest rates than traditional credit cards. We’ll dive into a few examples and the financial impact in a moment.

- Cardholder service is better with financial institution-issued credit cards. Store card customer service is not provided by the store personnel. The cashier is not going to be able to offer much assistance if there is a problem with your card or purchase, whereas your financial institution can.

- Store cards encourage overspending and living beyond your means. Retail cardholders often spend just to take advantage of rewards. Also, many consumers will apply for (and get) too many store cards. Multiple account balances and payments can quickly become unmanageable, possibly leading to late or missed payments, resulting in higher interest rates and risking a lower credit score (which impacts future purchase decisions, like cars and homes).

Why a Credit Union Issued Credit Card Might be a Better Option

Although there are several advantages to having a store card, a credit card from your local credit union tends to be the better option for daily purchases and maybe your only option for balance transfers and/or cash advances. Below are some popular benefits that may be offered by a traditional credit card. Again, always be sure to review a credit card’s fine print to make sure you’re getting the benefits you’re looking for.

Credit Union Card Rewards

Non-store affiliated rewards credit cards are often more attractive with rewards in the form of a check or statement credit, points to use toward merchandise or gift cards, or miles to offset travel expenses. A rewards credit card from your credit union might offer the following:

- Those with good credit may benefit from higher lines of credit vs. a store card

- Lower interest rates on average

- Earn rewards or cash back on your purchases

- Bonus rewards when spending on eligible categories

- Generous welcome bonuses

- Ability to redeem rewards for higher value, like premium flights or five-star hotels

- Opportunity to pool rewards with household members

- Additional benefits, such as hotel night rewards, waived checked bag fees, and airport lounge access

- Protection on purchases for returns, theft, or damage

- Extended warranties on eligible items

That being said, you’ll also want to keep in mind that:

- Rewards rates for specific retailers may be low with traditional cards.

- Traditional credit cards tend to have higher limits, which may mean more debt if you're not careful.

- Annual fees on traditional rewards cards can get very high, though plenty of no-annual-fee options exist.

Comparing Rates Between Store & Traditional Cards

Before comparing the rate differences between store cards and credit cards, let’s consider some of the most common types of rates on cards. These details are important to understand so you know how much you really pay after fees and interest are factored in.

Some of the most common types of credit card APRs to note are:

- Purchase APR: The rate applied to purchases you’ve made on the card.

- Balance Transfer APR: The rate applied on the balance that is transferred onto the card from another one.

- Cash Advance APR: The rate applied to the amount of cash borrowed from your credit card line. This would also apply to getting cash back while at a point of purchase. Also, note that this rate is often higher than a purchase rate and has no grace period (that means you start paying interest on that amount immediately).

- Penalty APR: The rate you’re charged if you make late payments or violate other terms. Roughly a third of all issued cards have these APRs, the average of them being 29.08% with the highest being 30.90%, both as of June 2022.

- Introductory APR: The promotional rate that some credit card issuers offer as a temporary incentive to enroll new cardholders. To make it attractive, it’s usually very low—sometimes 0%. Some important notes:

- This rate is not permanent.

- If you’re late in making a payment, a penalty APR may be enforced and negate the promotional rate.

Equipped with this understanding of rate types, know that store credit cards often have higher interest rates than traditional credit cards. In fact, at the time of this post, store credit cards have an average 24.91% APR while the average of all credit cards stands at 21.06% APR as of July 14, 2022, according to The Balance's weekly credit card interest rate survey.

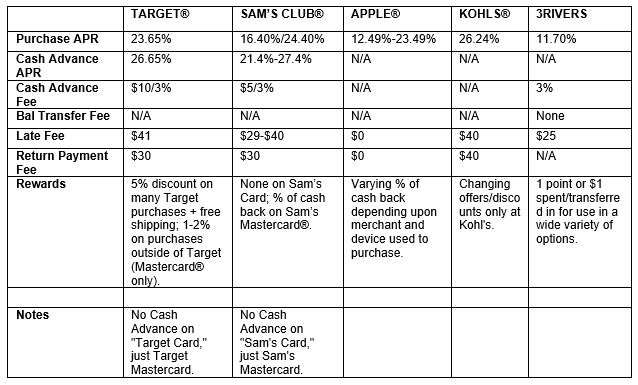

Having a higher interest rate means you’ll pay more when you carry a balance and it will take longer to pay off your balance. Let’s take a look at how this impacts you. Here is a comparison of four popular store cards and our 3Rivers Mastercard (all rate and fee amounts recorded as of July 29, 2022, and may no longer be accurate):

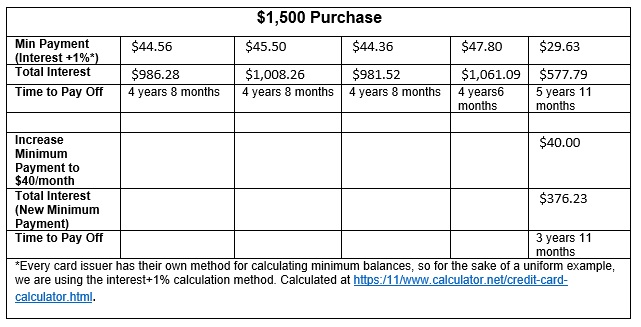

And here's a look at how long it would take to pay down a $1,500 balance on each of those cards:

You’ll note that, in the examples here, the 3Rivers card has a longer payoff time, but a significantly lower minimum payment amount. This is a result of the lower interest rate within the calculation. The lower minimum payment offers the flexibility of the cardholder to pay additional principal each month, so in the second example, the payment amount is set at $40 (still lower than the minimum of any other card shown). With this accelerated principal payoff, the time to payoff is actually just 3 years and 11 months (about half a year sooner than in any of the other examples).

For more information about our 3Rivers Mastercard®, including current rates, click here.

Can we help? We know there’s a lot to consider and many options to choose from when it comes to credit cards. We’d love to help you decide which card may be best suited for your lifestyle, spending habits, and financial goals! Schedule a time to talk with a 3Rivers team member today.

Article Sources:

Store Credit Card Overviews (recorded in July 2022):

- Purchase APR: 23.65%

- Cash Advance APR: 26.65% (available on the Target MC/Not Target Card)

- Cash Advance Fee: $10 or 3% of Amount

- Minimum Interest Charge: $1

- Annual Fee: None

- Late Fee: $41

- Returned Payment Fee: $30

- Balance Calculation Method: Daily

- Purchase APR: 16.40% or 24.40%

- Cash Advance APR: 21.40% (available on the Sam’s Club MC/Not Sam’s Club Personal Credit Card)

- Cash Advance Fee: $5 or 3% of Amount

- Minimum Interest Charge: $2

- Annual Fee: None

- Late Fee: $29-40

- Returned Payment Fee: $30

- Balance Calculation Method: Daily

- Purchase APR: 12.49%-23.49%

- Cash Advance APR: No Cash Advance on Apple Card

- Cash Advance Fee: No Cash Advance on Apple Card

- Minimum Interest Charge: N/A

- Annual Fee: None

- Late Fee: $0

- Returned Payment Fee: $0

- Balance Calculation Method: Daily

- Purchase APR: 26.24%

- Cash Advance APR: No Cash Advance on Kohls Card

- Cash Advance Fee: No Cash Advance on Kohls Card

- Minimum Interest Charge: $1

- Annual Fee: None

- Late Fee: Up to $40

- Returned Payment Fee: Up to $40

- Balance Calculation Method: Daily

All rate and fee amounts mentioned in this post were recorded as of July 29, 2022, and may no longer be accurate. Please visit official merchant websites to view current rates and fees.