Money Minutes: Subsidized vs. Unsubsidized

We know time is precious, and that you don't want to waste too much of it attempting to wrap your head around financial know-how. Educating yourself about money, though, is crucial to cutting the stress and potential mess in dealing with your money matters. Our Money Minutes posts help you make sense of personal finance and money-related definitions, concepts, and advice that can be tricky and confusing to break down. We'll help you make better sense of it in just a few short minutes! Today's topic is:

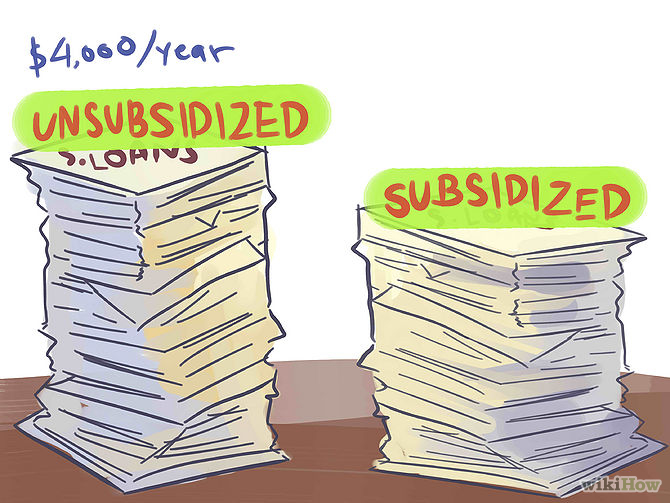

Subsidized vs. Unsubsidized

You were likely introduced to the terms, "Subsidized" and "Unsubsidized" when you were filing for financial aid in college. Still not sure what the two are, or how they differ?

Brief Breakdown

Subsidized: The federal government pays interest on subsidized loans during deferment periods. Unsubsidized: The interest on unsubsidized loans is not covered by the government, and remains the responsibility of the borrower.

What That Means for You

Subsidized loans are a less-costly option for students since the government covers interest during deferment periods. Basically, interest accrues on any loans while you're not paying them off, but that additional cost is taken care of by the government for subsidized loans. You'll owe the cost of the initial loan and interest on unsubsidized loans. Eligibility for subsidized loans is based on financial need, however, eligibility for unsubsidized loans is not.

Examples

Examples of a subsidized loan include the subsidized Federal Stafford Loan and the Federal Perkins Loan. Examples of an unsubsidized loan include unsubsidized Federal Stafford Loan and the Federal PLUS Loan.

Further Resources

Make a little more sense now? As always, if you need more information about this - or any other - financial topic, get in touch with 3Rivers. One of our team members would love to help!