Student Life: The REAL Cost of a Student Loan

The average American who takes out student loans will have accumulated just over $24,000 in debt by the time they graduate. However, that is not the amount they will be paying back to the financial institution that they borrowed it from over those 5-25 years of repayment. The real cost of a student loan can be complex and difficult to grasp, but I am here to try and break that down for you today.

Let me tell it to you in a story.

Ashley is a senior who just graduated high school last month. She is really excited to attend Indiana University in the fall, but she is nervous about the cost of attending college, so she decided to make an appointment with the financial aid office.

After an hour long conversation with the financial aid director she found out that she would need to take out $6,000 per year in private loans for the next four years. So at the end of it all, she would have $24,000 in private student loans. Or would she?

Let’s break it down. Let’s pretend like she took out the whole $24k to fund the rest of her four years of education as an incoming freshman (don’t do that by the way). She went through 3Rivers CU Student Choice (of course) to fill that gap in funding and was approved at a 6.25% interest rate (for this scenario let’s pretend that her rate stays the same throughout the life of the loan). Because she is such a great student, she will graduate in exactly four years in May of 2018. She doesn’t plan on working at all while she is in school, so she set up her loan to be totally deferred until six months after graduation. By the time November 2018 rolls around (after graduating and the six month grace period) she will have already gained $7,280 in interest on that loan, bringing her private student loan debt total up to $31,280.

Because she plans on taking a basic level job in a corporate office post-graduation, she plans on setting up her loan on a graduated repayment plan to help ease her into those loan payments. This will allow her to make lesser payments for the first two years after graduation, and then it will be re-amortized to meet the original 20 year repayment plan she was on. So for the first two years she only will pay around $178 per month and the subsequent years she will be paying around $239 per month. If she does this for the whole twenty years of the loan term, the total amount she would have paid back on the loan would be approximately $55,819.

This wonderful little calculator on our student loan website is a great tool to help you figure out how much a student loan could cost you over the life of the loan.

However, there have been plenty of studies done to prove that getting a higher education, even If you have to take out some student loans, is well worth it.

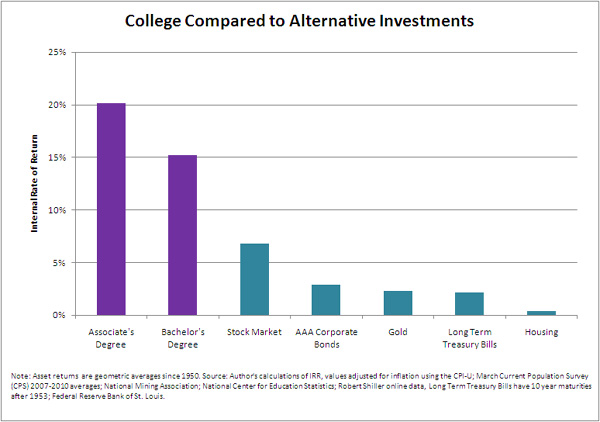

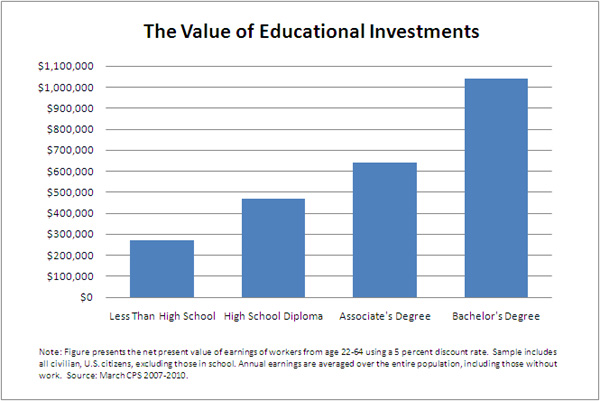

Statistics show that not only does a college education make you a better candidate for obtaining a job- you will qualify for significantly better paying jobs. According to the Brookings Institute, “on average, the benefits of a four-year college degree are equivalent to an investment that returns 15.2 percent per year. This is more than double the average return to stock market investments since 1950, and more than five times the returns to corporate bonds, gold, long-term government bonds, or home ownership.”

If the return on your investment in your college degree is almost double than that of investing in stocks and bonds, you have done something right. So don’t look at what your student loans won’t allow you to do, look at what they WILL allow you to achieve. Below are a couple of charts that will hopefully help you to truly make peace with your decision to invest in your higher education.

So don’t write off student loans, just because they are intimidating and accrue interest. It definitely pays off to attend college.

Stick around for my next guest blog where I will help you learn how to write a great scholarship essay, so that you – ideally- don’t have to take out large student loans!

More information here.