What You Should Know About the Parent PLUS Loan

We’ve outlined a few other loan types in previous posts, but haven’t dug deep on Parent PLUS loans yet – what are they, where do they come from, and are they the best option?

.jpg?sfvrsn=3c985b75_0)

If you’d like help exploring your college funding options, contact our experts today!

Who is responsible for the loan?

Parent PLUS are a unique student loan. While almost all other education loans are offered to the student as the primary borrower, the Parent PLUS loan is offered only to the parent or guardian of a dependent student. The legal responsibility to repay the loans falls solely to the adult taking the loan, so students have no obligation to make payments, and won’t ever receive monthly statements. Depending on your student’s involvement, they may not even know the loan exists!

All legal responsibility for the loan falls on the parent. Not paying the loan can result in harsh consequences like wage garnishment, withholding tax returns, and damaged credit history. Parent PLUS loans are difficult to discharge in bankruptcy, and there is sometimes limited assistance provided to borrowers to help with repayment. Before accepting Parent PLUS loans, or any student loan, it’s wise to know the risks and responsibilities and to plan accordingly.

Do I qualify?

If you’ve already received your Financial Aid Award Letter outlining expected costs for the upcoming school year, you may see “Parent Loan” as an option. Just because the loan appears on the Award Letter doesn’t mean you’re automatically qualified, but eligibility for Parent PLUS loans is pretty broad!

This loan type intentionally has fewer eligibility requirements than private student loans, making it easier to qualify for. Private student loans typically consider debts, income, pay history, credit score, and other factors, but Parent PLUS loans only look for evidence of certain derogatory marks on credit histories. Bankruptcies, current delinquencies, repossessions, and other specific situations can trigger a “Declined” status. If you have specific questions about qualification criteria, check out this guide published by the Department of Education.

Even with certain credit issues, the loan can still be approved by adding an endorser, or cosigner, to the loan. Endorsing a Parent PLUS loan is promising to repay the loan if the primary adult doesn’t, so the loan servicer can use the same collection practices on borrowers and endorsers alike.

How do I apply for a Parent PLUS loan?

One of the big upsides to Parent PLUS loans is that they can be processed quickly and completely within the financial aid office. Each school has its own policies for application and funding, so contact your school’s financial aid office directly to begin the process.

When calling the financial aid office, ask to speak with the financial aid officer who oversees your university account. The front-line staff may ask for your student ID number to identify you and determine your specific officer, so have it handy!

Parents calling in may need to have FERPA clearance on file with the school – FERPA is the “Family Educational Rights and Privacy Act” and dictates privacy procedures. Parents of college students are not automatically entitled to view academic records, financial information, or other university account statuses. If you want to access accounts, be sure to add parents to FERPA lists!

What’s my interest rate going to be?

Parent PLUS loans are offered at fixed rates, with everyone who qualifies for a Parent PLUS loan receiving the same interest rate regardless of credit history or income.

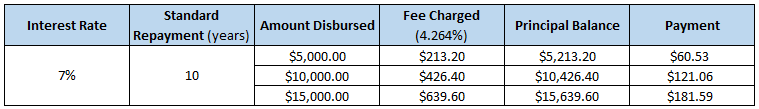

For the 2017/2018 school year, the interest rate offered to all applicants is 7%. There is an additional 4.264% fee on all disbursements, so for every $1,000 disbursed, the borrower is charged $42.64.

Everyone receiving the same rate is great news for families with limited or damaged credit histories, as they can potentially find a lower rate with the Parent PLUS loan than with a private student loan, where interest rates for lower credit scores range from 10 to 15%.

For families with stronger credit and income histories, it may be best to hunt for better rates and more favorable terms elsewhere.

How much will my payment be?

Below is a summary of payments by taking a Parent PLUS loans of various amounts for one school year. For a rough payment estimate for additional school years, multiply the payment by number of years of funding needed.

Note: These numbers and examples are for educational purposes and may not reflect your own personal savings. Every financial situation is unique - rates and savings are influenced by a number of factors.

Recipients of the Parent PLUS loan are typically expected to make payments as soon as the loan is fully paid out, but other repayment options are available. From the savings perspective, paying on Parent PLUS loans (and other loans) while the student is enrolled is tremendously helpful as it prevents significant interest costs. Here’s a related post with additional details!

As always, if you have questions regarding your (or your child’s) education, please contact us! We are here to help with finding schools, choosing majors, and paying for college effectively.