Financial Education

-

First-Time Auto Buyer Quick Guide

3Rivers is here to help first-time car buyers prepare for, pay for, and maintain their new set of wheels. We make sense of the sometimes hard-to-understand financial aspects and provide you with the tools that let you do your car shopping and buying where, when, and how you want to. So, what are you waiting for? Your next adventure starts here!...

-

5 Steps You Should Take Before Getting an Auto Loan

Here are five steps you should take before applying for an auto loan....

-

3Rivers is here to help you in your preparation, we have outlined six major expenses that occur in the car buying (and owning) process. Some are obvious, whereas others you may not have considered. Taking all of these into consideration will save you time, money, and stress in the long run!...

-

Steps to Take if You're in a Car Accident

3Rivers First Time Auto Buyer Guide: Steps to Take if You're in a Car Accident....

-

Understanding Your Credit Score & Report

At 3Rivers, we believe establishing a good credit history is important to your future borrowing ability. Your first car loan is often your first credit obligation, so handling it properly is essential. On-time payments are vital to a good credit rating and future loans from the lender. Even one late payment appearing on your credit report can have a major negative impact on your credit score....

-

From appraisal to VA loan, we have you covered. We have put together a list of highly used terms used during the mortgage process. 3Rivers is here to help educate you no matter the time of day. ...

-

When reaching the decision to purchase your first home, it is crucial that, before signing your name on the purchase agreement, you have the education you need to make sure you’re fully informed and comfortable with the process, and that, as a result, you get the right home at the right price for your personal and financial needs....

-

The Process of Getting a Home Loan

Unless you've saved up the full purchase price of the home you're looking to buy and plan to pay in cash, you'll probably need to take out a home loan. Here are a few of the basics you need to know....

-

Pre-Qualification vs. Pre-Approval

The difference between pre-approval and pre-qualification is the difference between, “Yes, you’ve passed the test and are approved” and, “Based on the information you’ve provided, it looks like you might pass the test and will likely get approved.”...

-

Steps to Take After Getting Approved

Here are the steps you will be required to take once you’re approved for your home loan and ready to close on the home of your dreams....

-

You’re borrowing a large amount of money and your lender will ask many questions and request even more proof to determine whether or not you can realistically afford to purchase a home. So, what will they take into consideration?...

-

The people involved in your home purchase offer support, ensure the process is legal, and provide protection and peace of mind for everyone involved. These stakeholders may include the realtor, the real estate lawyer, and the appraiser....

-

Deciding on What Type of Home to Buy

Once you’ve made the decision to buy your own home, visited 3Rivers to make sure you can arrange financing, and speak with a loan officer to determine how much home you can afford, what’s next? The fun part!...

-

Whether you choose to buy or rent your home depends upon your life situation and personal preferences, as well as the bottom line....

-

One of the biggest decisions that come with applying for a home loan is whether or not to make the purchase with your spouse or partner. For some couples, this is a no-brainer....

-

Tips for Applying for Grants & Scholarships

The process of applying for grants and scholarships can feel daunting at first – applications can often be lengthy and require what seems like a great deal of information. Here are some tips to get you started!...

-

Student Education: College, Career Pathways and Financial Goals

Our college advisors pride themselves on taking the time to help you plan your next steps - from your best college, career, and funding options....

-

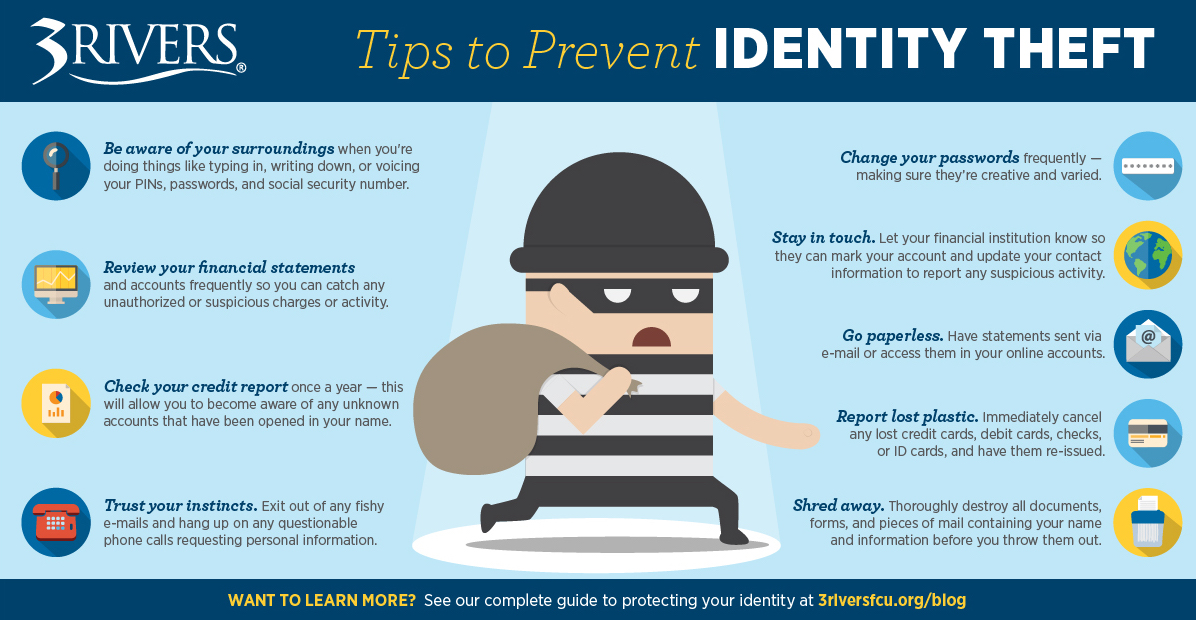

Tips to Prevent Identity Theft

HOW TO PREVENT IDENTITY THEFT: Once an identity thief gets their hands on your information, they may be able to use your information to open a line of credit, land a job, file a tax return, drain your retirement savings, give the authorities your name if they're arrested, and so much more. Taking the proper steps to prevent yourself from fraud is crucial....

-

When the unexpected happens, 3Rivers can help with a variety of products designed to protect you and your good credit in case the unthinkable happens....

-

Protecting Yourself and Others

Education and awareness is the best way to protect yourself and each other. 3Rivers works very hard to monitor and protect your accounts. It is very important that you keep your contact information updated....

-

ACT IMMEDIATELY. If it involves your 3Rivers account, please let us know....

-

3Rivers cannot stop fraudulent activity before it starts, it's crucial to have plans in place to help protect members after it happens....

-

3Rivers can help with resources to report any possible fraud activity to the company that's falsely represented....

-

Identity theft is serious. It could affect you or someone you know at any time. It happens when someone takes your personal information – like your account numbers or Social Security number – and pretends to be you so they can run up charges. Let 3Rivers help with tips to prevent these from happening to you or a loved one....

-

From closed account hoaxes, internet auctions, phishing, skimmers, cyber security and a number of other scams, 3Rivers can help. Detecting it is the first step, let us help! ...

-

How 3Rivers Protects Your Accounts?

3Rivers is a leader in using technology (EMV Cards, Fraud Monitoring System & Text Alerts) to protect members' accounts at the purchase level and monitors every member’s account for suspicious activity....

-

5 Steps You Should Take Before Getting an Auto Loan

Here are five steps you should take before applying for an auto loan....

-

Understanding the Credit Union Difference

CREDIT UNIONS VS. BANKS: While credit unions offer all of the products and services you’d expect from a financial institution, and are federally insured, they're different in that they exist on the philosophy of “people helping people.”...

-

Tips to Prevent Identity Theft

HOW TO PREVENT IDENTITY THEFT: Once an identity thief gets their hands on your information, they may be able to use your information to open a line of credit, land a job, file a tax return, drain your retirement savings, give the authorities your name if they're arrested, and so much more. Taking the proper steps to prevent yourself from fraud is crucial....

-

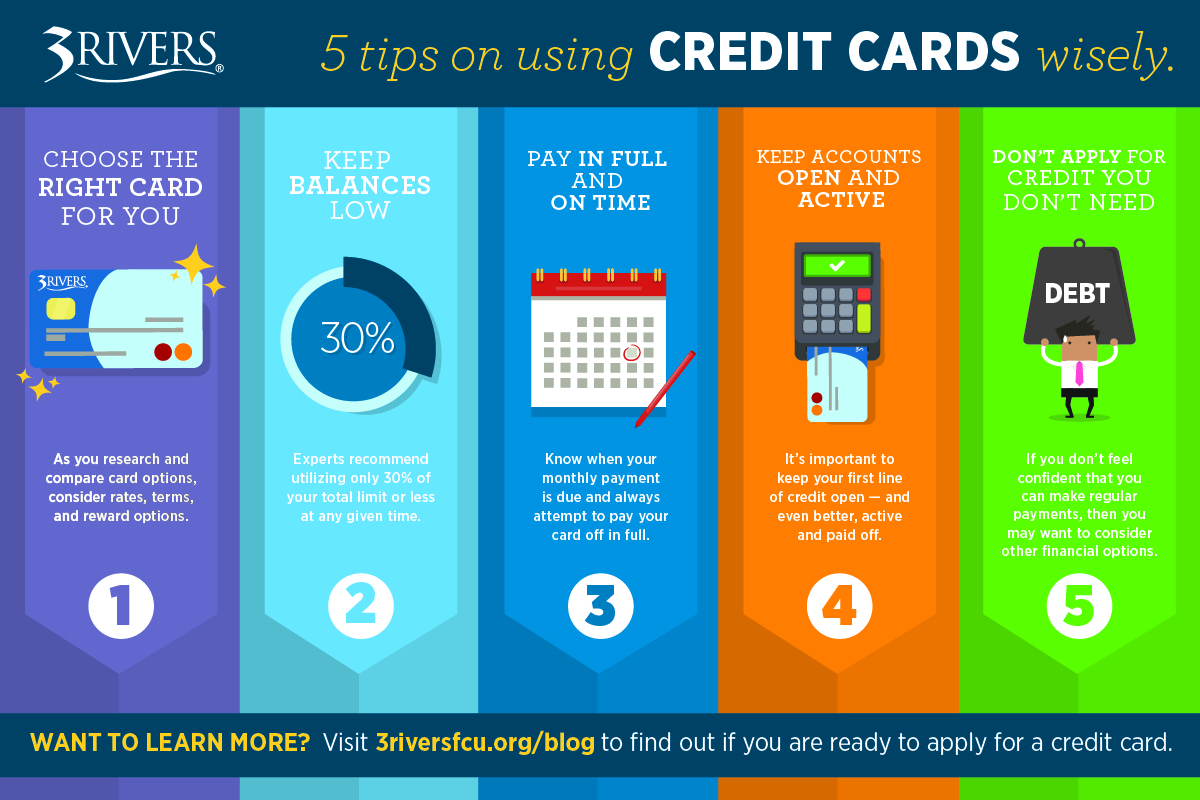

5 Tips on Using Credit Cards Wisely

5 TIPS FOR USING CREDIT CARDS WISELY: Credit cards are a hot topic when it comes to personal finance. While some people advise not getting a credit card because of how quick and easy it is to rack up debt, there are also benefits to signing up for one – especially when it comes to help building your credit. The key, though, is using them wisely....

-

HOW CREDIT SCORES ARE CALCULATED: Your credit score plays many important roles in your finances. Working to build a good, strong score can help to support any budgets you have in place, get you approved for new lines of credit, save you money by helping you to qualify for lower interest rates on loans, and more....

-

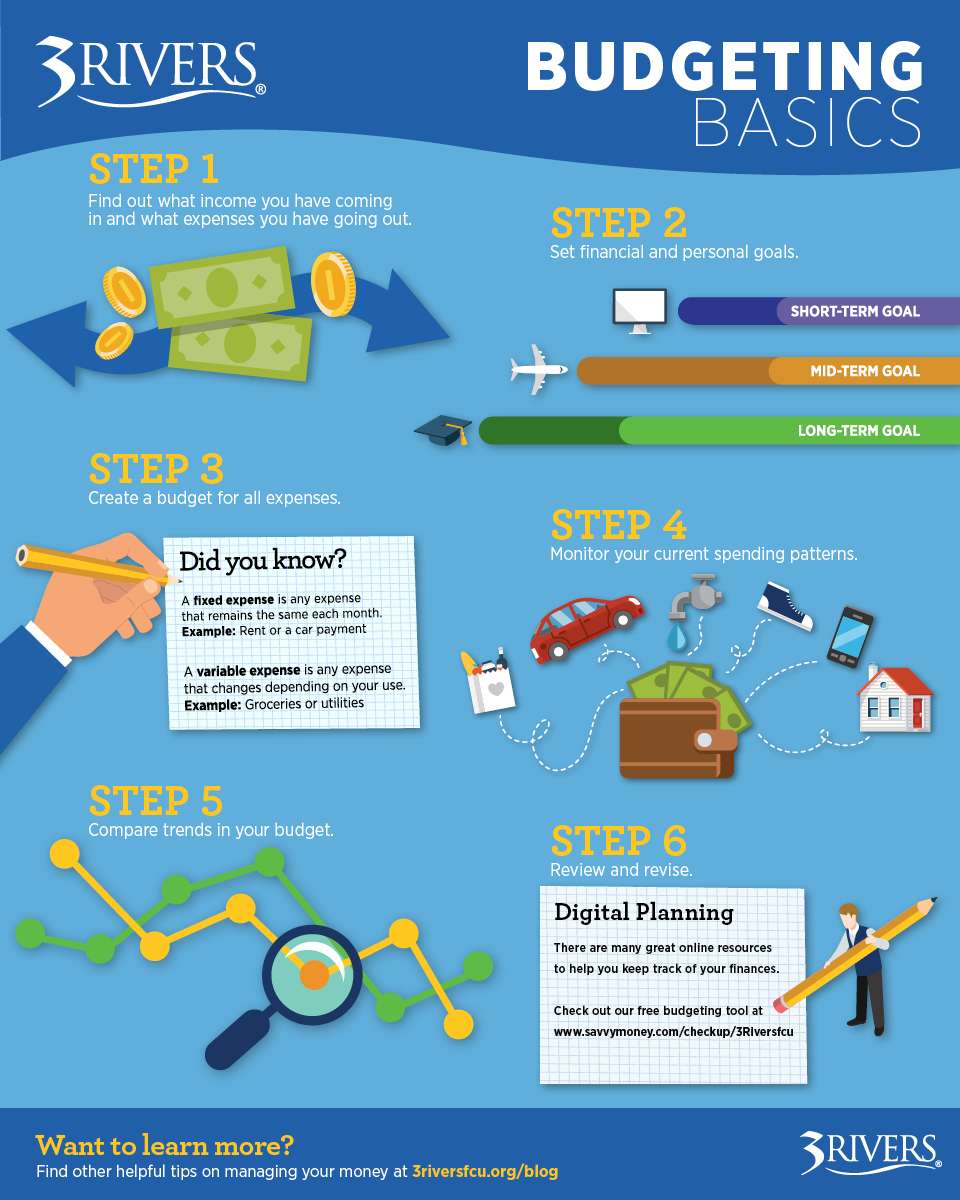

Budgeting Basics: How to Create a Budget

3Rivers Financial Education: CREATING A BUDGET: A detailed budget can help us achieve our financial goals and develop a plan on how to get there....

_800_534.png?sfvrsn=4ea9b849_0)