Card Skimming: What Are Skimming Devices + How Can You Stay Safe?

What is Card Skimming, Why is it Happening More Often, and How Do I Stay Safe?

While it’s hardly a new tactic, incidents of card skimming at point of sale terminals are on the rise. In particular, it’s happening frequently at fueling stations that have pay-at-the-pump convenience – which is pretty much all of them. Making matters worse, with technology getting more sophisticated, the presence of card skimming devices is less detectable. And, thanks to a delay in the enforcement of EMV technology at fueling stations, the pumps are a favorite skimmer target.

Thieves are targeting station pumps because most of them have not yet adopted EMV technology to accommodate EMV chip enabled cards. They have until October 2017 to update their terminals, which means the magnetic strip has to be used for such transactions. That makes it easy for thieves to compromise and manufacture a bogus card they can use, making it a lucrative option for them.

What are Skimmers?

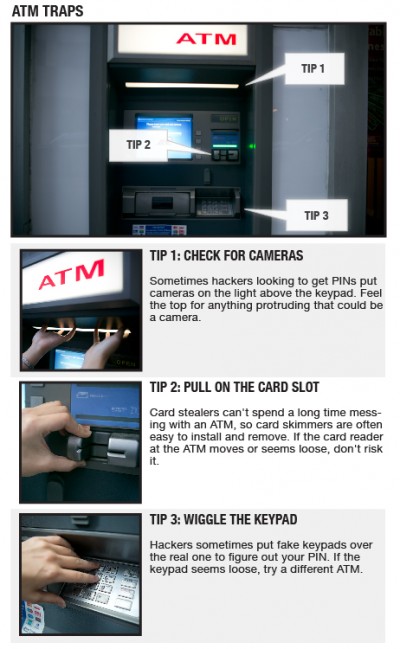

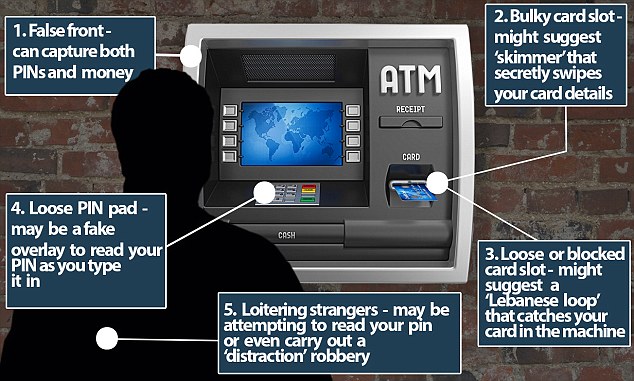

Skimmers are mini card readers that grab the data off a card's magnetic strip. These devices are attached to real payment terminals so they can read the card’s data from every swipe that happens. Sometimes, the thief will place a hidden camera in the area to also record PINs as they are entered. It could be in the card reader, mounted overhead, or even just to the side, inside a plastic brochure holder. There may even be a fake PIN pad over the actual one.

With the stolen data in hand, the thief can create cloned cards and use them in various ways.

How to Avoid Skimming Devices

- Go Inside: At fueling stations, consider going inside to pay instead of paying at the pump.

- Be Aware: Be suspicious if there’s a broken security seal, or the word "void" appears on it. These are part of an industry program to reduce gas pump tampering.

- Be Choosy: Select pumps that are closest to the physical building, not those that are hidden around the corner.

- Pay attention to how well the reader handles the card: A skimmer device can sometimes create an unusual feel – the card may stick or just not feel quite right. If that happens, cancel the transaction and go inside to pay and report your concern.

- Check for Tampering: When you approach any exterior transaction terminal, check for obvious signs of tampering. If something looks out of place, such as a different color or material, graphics that aren't correctly aligned, don't use it. Also, most devices are well constructed, so there should be no loose parts.

- Guard Your Steps: Whenever you enter your PIN, assume someone is looking. Maybe it's over your shoulder or through a camera. Cover the keypad with your hand when you enter your PIN.

- Consider a Digital Wallet: If the credit card terminal accepts NFC transactions, consider using Apple Pay, Samsung Pay, or Google Pay (formerly Android Pay), available at 3Rivers. These services tokenize your credit card information, so your personal information is never exposed. If your data is somehow intercepted, it’s useless to them because it’s not an actual card number.

- Know what a card skimmer looks like: Take a look at this historical review of card skimmer devices at Krebs on Security. It shows just how well thieves have been able to improve at hiding their devices over the years.

What to Do If You Think You've Spotted a Skimming Device

Immediately let the merchant or your financial instituion know so they can take proper action in contacting the police. Do not attempt removing the device yourself

What to Do If Your Credit Card Is Skimmed

In addition to all the advice offered above, pay attention to your statements or regularly check your activity using Online Account Access or Mobile Banking. Verify all the charges are correct. If you find that your card has indeed been skimmed or otherwise compromised, call the issuer immediately to let them know.

At 3Rivers, we’ve invested in EMV technology to help keep our members' data safe. It’s not foolproof, though. That’s why we’ve also invested in other services, including the ability to instantly issue your plastic at our branches. This way, if your card is at risk, we can produce a new one within minutes and get you back into the rhythm of your life.

You might also like: Fraud Protection at 3Rivers | Tips to Prevent Identity Theft | How to Create Strong + Secure Online Passwords | Fraud Prevention Resources