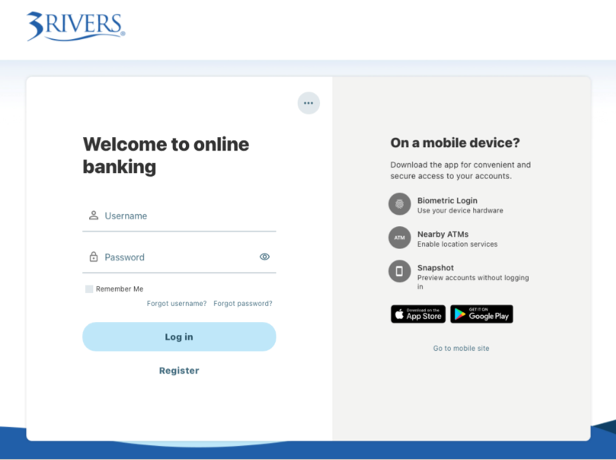

Online & Mobile Banking

Our online and mobile banking platforms are now fully integrated with each other—which means they look and operate the same way, whether logging in on your desktop or on your phone or tablet. And 3Rivers business members no longer have to use a separate app!

Several new features are now available to our members, free of charge. These tools not only add extra convenience to your on-the-go banking, but support you in monitoring your financial health and reaching your financial goals.

Our updated digital banking platforms now allow you to:

- Receive real-time account alerts.

- Monitor spending trends and set savings goals.

- Chat with a 3Rivers team member from within your online and mobile banking account.

- Access financial literacy tools and articles.

- Customize your online and mobile banking homepages based on what’s most important to you.

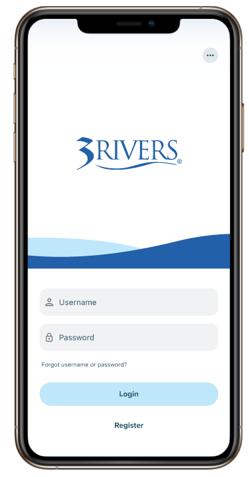

Mobile Banking

We’ve recently launched a brand new mobile banking app, with more features than ever before! Experience better on-the-go banking today. Learn more.

Our mobile banking app puts 3Rivers in the palm of your hand, so you can manage your money anytime, anywhere! Transfer balances between accounts, deposit checks, control your cards, monitor your credit score, set savings goals, and so

much more—all with just a few clicks.

Download the 3Rivers Mobile Banking app today by clicking the appropriate icon below, or searching "3Rivers" in your mobile device’s app store. Sign-in using your Online Account Access

user ID and password.

Download the Mobile Banking App Now!

Need assistance? If you have additional questions, or need help accessing your accounts, give us a call at 800.825.3641.

_202_60.png?sfvrsn=f0eaffa2_2)