At 3Rivers, we know that what matters most to one of our members likely differs from what matters most to another. We believe that meaningful relationships and conversations go a lot further than the products and services we have to offer, and that truly getting to know you is the key to helping you achieve your financial goals and dreams.

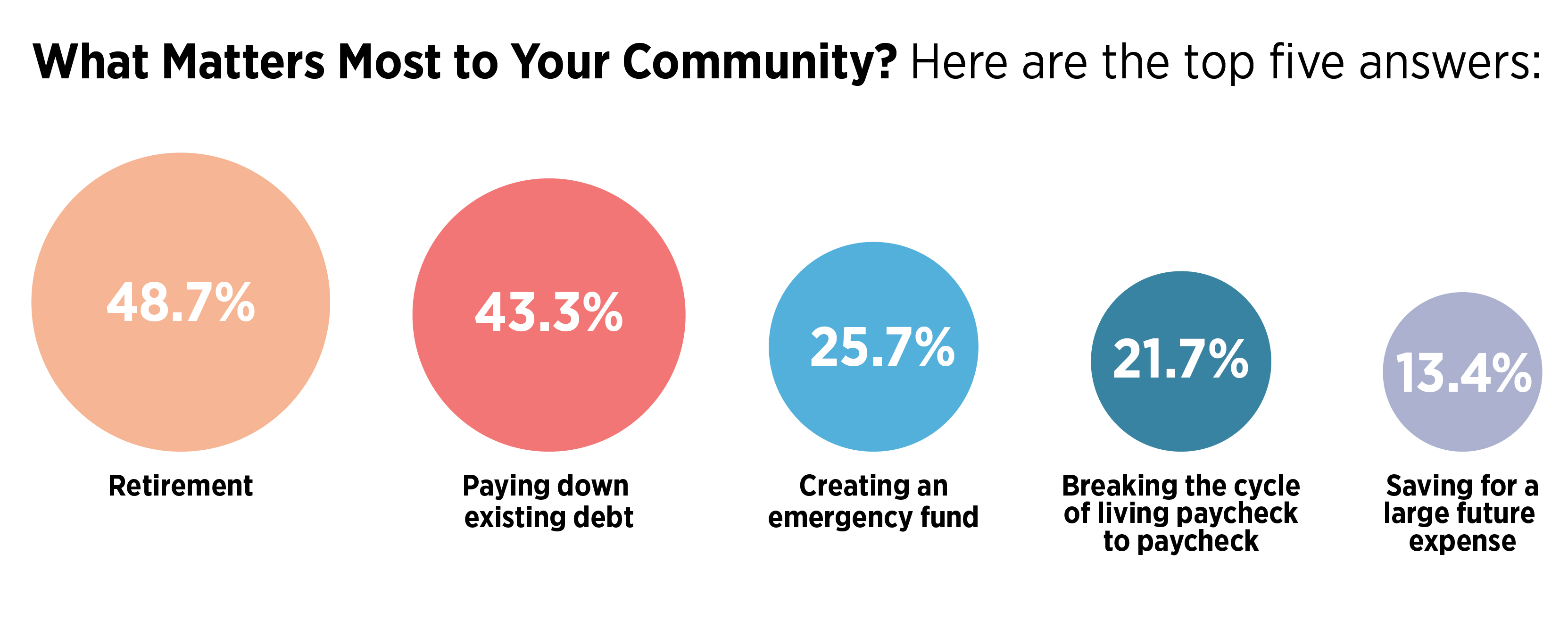

To get a better idea of what’s currently on the minds of those in our community, we asked.* And while the responses varied greatly, there were several common themes—almost all of which tie into the collective goal of creating a brighter future and experiencing financial freedom.

From paying down debt to saving for retirement, affording college to building an emergency fund, and all of those goals in between—we’re here to help. We invite you to explore this page for tools, resources, and key information about some of the most popular concerns in our community.

What matters to you, matters to us. And we’re here to support whatever that may be.

If you’re ready to take action on your biggest financial goals, we’re ready to help. Get in touch with us today! Schedule an appointment, give us a call at 800.825.3641 or visit your nearest branch.

Haven’t had a chance to tell us what matters most to you? Take the survey now!

*Data gathered from online survey conducted in October 2020.